Dublin, May 02, 2024 (GLOBE NEWSWIRE) -- The "United States Oil Refining Market, By Region, Competition, Forecast and & Opportunities, 2019-2029F" report has been added to ResearchAndMarkets.com's offering.

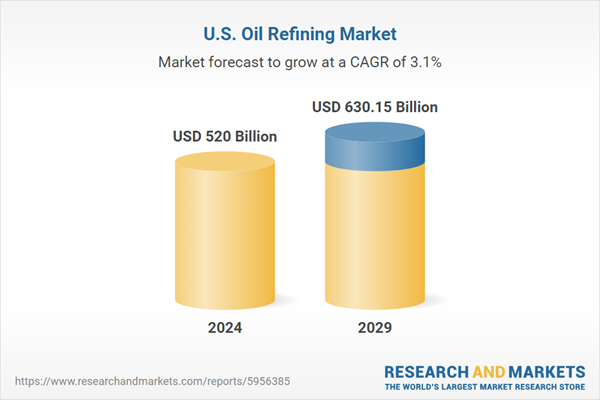

United States Oil Refining Market was valued at USD 520 billion in 2023 and is anticipated to project robust growth in the forecast period with a CAGR of 3.1% through 2029.

The United States oil refining market stands as a vital pillar of the nation's energy landscape, characterized by its substantial capacity and strategic significance. Representing one of the world's largest refining sectors, it comprises a diverse array of facilities strategically positioned across the country.

Boasting advanced technologies and infrastructure, these refineries cater not only to domestic demand but also play a crucial role in United States Oil Refining Market. The market's resilience and growth stem from a combination of factors, including robust consumption patterns, evolving regulatory frameworks, technological innovations, and strategic investments in upgrading existing facilities.

Additionally, the sector's adaptability to fluctuating crude oil prices and its ability to refine a variety of crude oil grades position the United States as a key player in the global energy landscape, influencing not just regional but international energy dynamics.

Transition towards Clean Energy and Renewable Fuels

A prominent trend revolutionizing the U.S. oil refining market is the accelerating transition towards clean energy and renewable fuels. With increasing global emphasis on sustainability and decarbonization, refineries are actively pivoting towards producing cleaner, low-carbon, and renewable energy products. This trend aligns with the growing demand for alternative fuels, including biofuels, hydrogen, and synthetic fuels, as viable alternatives to traditional petroleum-based products.

Refineries are investing in renewable energy integration, such as biofuel refining units and renewable diesel production facilities, diversifying their product portfolios to meet evolving consumer demands and regulatory requirements. Additionally, partnerships and collaborations between refineries and renewable energy companies are fostering innovation and accelerating the development of sustainable fuel technologies, indicating a fundamental shift towards a greener and more diversified energy landscape.

Digitalization and Advanced Technologies Adoption

The integration of digital technologies and advanced analytics is revolutionizing operations within the U.S. oil refining sector. Refineries are increasingly embracing digitalization, deploying sophisticated data analytics, machine learning, and IoT (Internet of Things) solutions to optimize processes, enhance efficiency, and ensure operational resilience.

Real-time monitoring of equipment, predictive maintenance, and process optimization through digital twins are becoming standard practices, enabling refineries to reduce downtime, improve safety, and optimize energy consumption. Moreover, leveraging artificial intelligence (AI) and big data analytics enables refineries to make data-driven decisions, optimize supply chains, and enhance product quality, thereby driving operational excellence and competitiveness in the market.

Focus on Petrochemicals and High-Value Products

An emerging trend in the U.S. oil refining market is the increasing focus on petrochemicals and high-value products. Refineries are strategically diversifying their product portfolios, placing greater emphasis on petrochemical production to capitalize on the growing demand for plastics, polymers, and other chemical derivatives.

This shift aims to maximize margins by capturing value from intermediate products derived during the refining process. Investments in upgrading facilities to enhance petrochemical production capabilities and the development of integrated refinery-petrochemical complexes signify refineries' efforts to tap into higher-value markets. Additionally, innovations in refining processes enable the extraction of more specialized products with unique properties, catering to niche markets and bolstering profitability amidst evolving consumer demands.

Resilience and Adaptability in Supply Chain Management

The volatility induced by global events has prompted a focus on resilience and adaptability in supply chain management within the U.S. oil refining sector. Refineries are reevaluating supply chain strategies, prioritizing flexibility, and establishing robust contingency plans to mitigate risks associated with supply disruptions.

Embracing agile supply chain models, diversifying crude oil sourcing, and exploring alternate transportation routes ensure continuity of operations even in challenging circumstances. Additionally, investments in storage infrastructure and inventory optimization play a pivotal role in enhancing supply chain resilience, enabling refineries to respond swiftly to market changes and maintain a reliable supply of refined products.

Evolving Trade Dynamics and Global Market Shifts

Shifts in trade dynamics and evolving global markets significantly influence the U.S. oil refining industry. The sector is adapting to changes in international trade patterns, including shifts in crude oil trade flows and changing demand profiles from emerging economies. Geopolitical factors, trade agreements, and economic policies influence the flow of crude oil and refined products, shaping market trends and refining strategies.

Moreover, changing consumer preferences, economic growth trajectories in different regions, and geopolitical tensions impact refining margins, product pricing, and market competitiveness, necessitating refineries to continuously reassess their market positioning and global trade strategies.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 86 |

| Forecast Period | 2024 - 2029 |

| Estimated Market Value (USD) in 2024 | $520 Billion |

| Forecasted Market Value (USD) by 2029 | $630.15 Billion |

| Compound Annual Growth Rate | 3.1% |

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the United States Oil Refining Market.

- Exxon Mobil Corporation

- Chevron Corporation

- Phillips 66 Company

- Marathon Petroleum Corporation

- Valero Energy Corporation

- Royal Dutch Shell PLC (Shell Oil Company)

- BP America Inc.

- ConocoPhillips Company

- PBF Energy Inc.

- HollyFrontier Corporation

Report Scope:

United States Oil Refining Market, By Complexity Type:

- Topping

- Hydro-Skimming

- Conversion

- Deep Conversion

United States Oil Refining Market, By Product Type:

- Light Distillates

- Middle Distillates

- Fuel Oil

- Others

United States Oil Refining Market, By Application:

- Transportation

- Aviation

- Marine Bunker

- Petrochemical

- Residential Commercial

- Agriculture

- Electricity

- Rail Domestic Waterways

- Others

United States Oil Refining Market, By Fuel Type:

- Gasoline

- Gasoil

- Kerosene

- LPG

- Others

United States Oil Refining Market, By Region:

- South US

- Midwest US

- North-East US

- West US

For more information about this report visit https://www.researchandmarkets.com/r/jxieru

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment